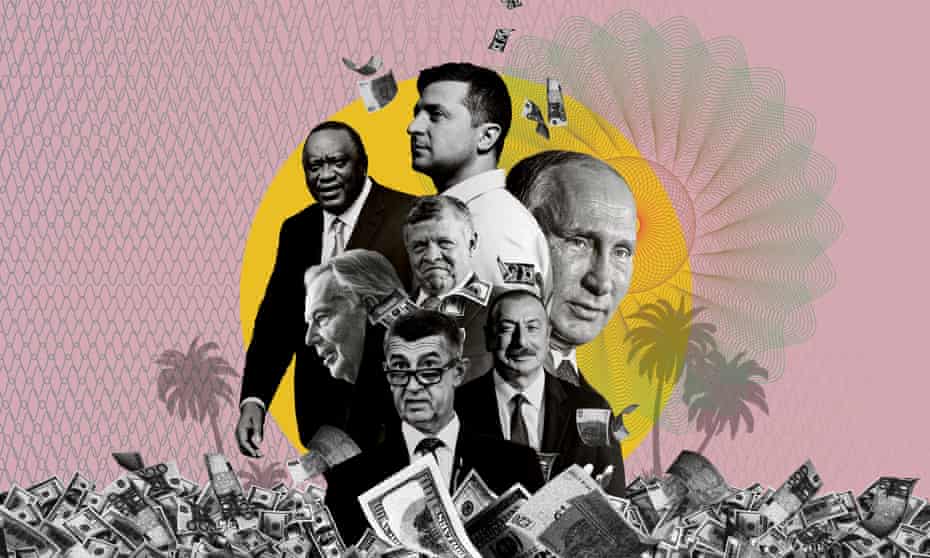

Leaked Pandora Papers Reveals how Wealthy Families Keep their Riches Hidden

A data leak dubbed the Pandora Papers has revealed that billionaires, as well as current and former world leaders, have been affiliated with companies that use offshore tax-havens.

The investigation was carried out by the International Consortium of Investigative Journalists and a team of 150 news outlets, including in Australia.

The 11.9 million documents revealed that 35 current and former heads of state as well as more than 330 politicians and public officials from almost 100 countries have assets in offshore accounts, secretive foundations, or shell companies.

Offshore accounts are often used to manage large sums of money covertly to hide a person’s true wealth.

Similar to the Panama Papers, the documents were reportedly leaked by an anonymous source. It is the biggest leak to date containing information on tax havens.

On Monday, the tax office said it would analyze information in the data leak to see if there were any Australian links.

“While the information in data leaks is interesting, we don’t rely on data leaks to do our job. We detect, investigate and deal with offshore tax evasion year-round,” ATO deputy commissioner and serious financial crime taskforce chief Will Day said

“We are well connected locally and globally in our efforts to fight financial crime. We will certainly look at this data set and compare it with the data we already have to identify any potential connections.”

He said it was important to remember that being included in a data leak did not automatically mean that there had been tax evasion or crime.

“There is a range of legitimate reasons that someone may have for an offshore bank account or structure,” he said.

“We know most Australians do the right thing. However, there are some who attempt to hide their ownership interests or financial misdoings through offshore arrangements.”

The Panama Papers came to the public in 2016 due to a data leak.

They were documents from the Panamanian law firm Mossack Fonseca, which were evaluated by journalists around the world.

They found that numerous politicians, athletes, and other celebrities had assets in offshore companies.

The revelations put politicians, business people, and celebrities under significant pressure.